5 Areas We Invest In & Why

5 areas we invest in;

At Fortem Capital, we believe in a two-tier approach when it comes to investing within the blockchain space.

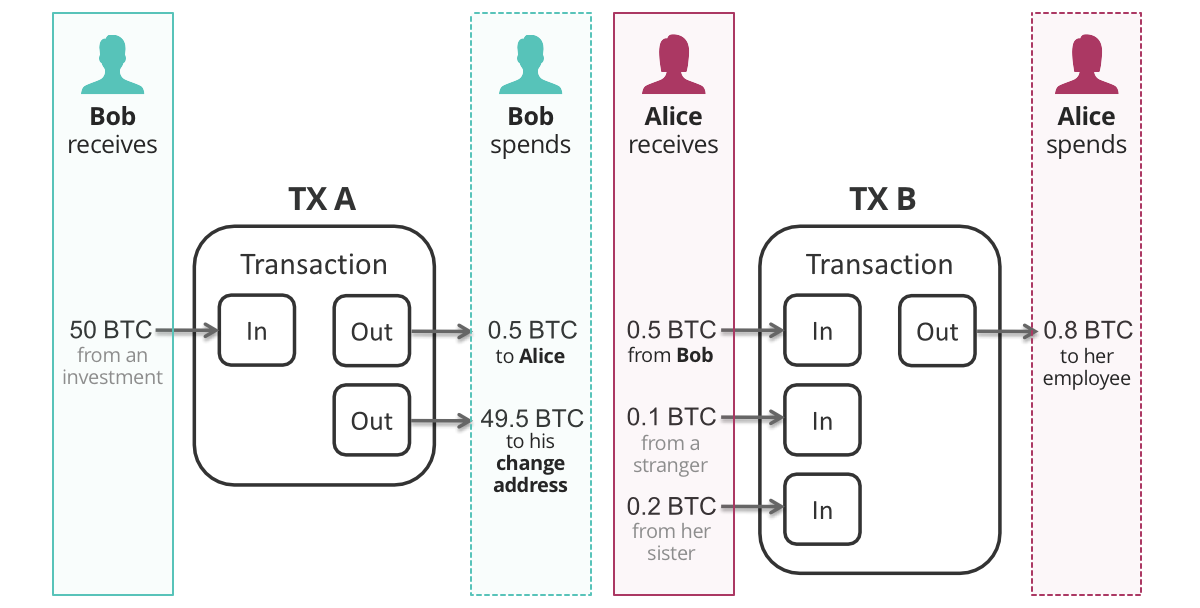

A blockchain is a digital register thats stores information which is shared and copied simultaneously with other users over the network. Once the information is entered, it is verified by other users on the network and if approved,

it cannot be altered or erased unless the majority of the network decides to do so.

Bitcoin serves to the first practical illustration of a blockchain.

We invest into improving blockchain technologies on an infrastructural level, looking at improving core issues in order to increase case use clarity and user base. The following segment will break down our analysis of where most

investment is necessary to improve the technology and secure the highest rate of return.

We believe in a two-tier approach when it comes to investing within the blockchain space. Understanding that before actual case-use within this sector is defined, a few key issues need to be tacked. Investment into the blockchain space should be done in a two cycle approach. The first approach involves building infrastructure and the second approach involves case-use, as clarity within the space increases.

The following areas in our opinion deserve the most investment.

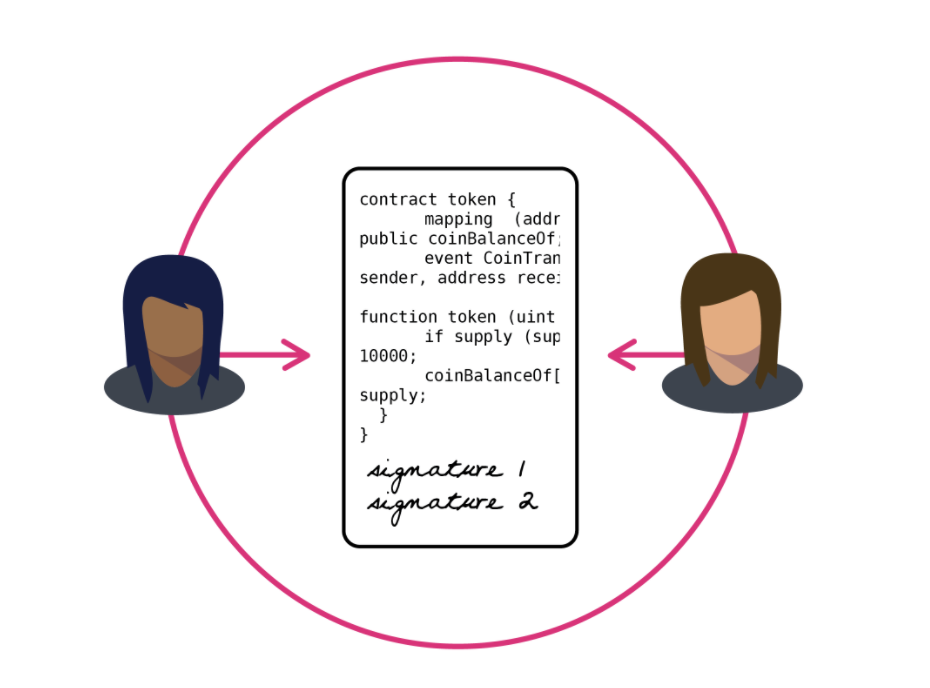

1. Smart Contracts

Smart contracts are an important part of blockchain development. It automates the process of contracts and streamlines existing deal-making processes. As forging contracts are placed into the blockchain, it creates two very important

processes;

1. Accountability on all parties, a clear record of the terms is created and available to all parties involved in the process. These terms cannot be changed unless they are agreed beforehand and included in the contract.

2. Execution is guaranteed once all terms of the contract are fulfilled and thus, the smart contract releases the funds that are held within it.

Although in the past few years, we have seen platforms like Ethereum and

Tezos create vast and powerful decentralised smart contract platforms, it is still an area that requires tremendous growth and development.

Smart contracts are lacking in certain areas and we feel that investment into the following areas would be more appropriate;

Decentralized Oracles

Smart contracts can only fulfil their full potential once external data can be accessed and verified. This involves relying on a central third party entity which introduces the same risk of trust and thus making smart contracts

a highly risky proposition as a single data input failure can create irreversible consequences. We extensively look at decentralised oracles with built in governance and incentive mechanisms to allow for decentralised data

feeds into smart contracts. Blockchains are verifiable and so can be the data. Chainlink is a great example of a decentralised oracle that has acheived vast growth in the recent years.

Lack of a programming ecosystem

Different blockchains have different approaches to programming within their ecosystems. Ethereum for example has developed an entirely new programming language called Solidity. Creating a massive learning curve for many developers

moving into the space as it takes into account the differences between blockchains and their requirements. One simple mistake when writing a somewhat complex contract on ethereum can have undesired consequences for e.g.

miscalculating gas costs for complex executions.

Security

Smart contracts always carry the risk of coding errors. Unlike most coding errors, these cannot be fixed when they have been executed and thus, its entry into the space remains a very complicated issue especially with high

volume executions.

2. Interoperability

Interoperability is an important factor when looking at the current blockchain ecosystem. As blockchains increasingly evolve, it is becoming clear that the race is not for the one blockchain to win it all but furthermore, multiple

ones all serving their specific case-use within the space. With this in mind, interoperability and cross-communication between blockchains have become a vital component of any investment strategy. Although the staggering

number of growing blockchains, they still remain isolated. Interoperability allows blockchains to share information back and forth across multiple blockchains. This will allow users from different blockchains to freely

send and receive assets from and into their respective blockchains.

Interoperability can be a complicated setup, it comes with it own compromises and therefore, we will break them down into two categories;

Open Protocols

Open Protocols function act as standardized pathways for blockchains that allow them to communicate and exchange data with each other. It allows interoperability without the need for a property interface or gateway

between them. A common example of this can be an atomic swap. Atomic swaps are sometimes called “peer-to-peer” trades because the trade is made wallet-to-wallet. Atomic Swaps are also referred to as “trustless.”

This means it is not necessary for traders to trust other traders or a centralized middleman, like a cryptocurrency exchange. In fact, Atomic Swaps do not require proxy tokens, escrow services or any other type

of third-party.

Multi-chain Protocols

In its simplest form, multichain protocols are ecosystems that aid and allow open communication and cross-transfer of value and data between blockchains. This solution differs from open protocols as it requires a separate

environment for other blockchains to plug in and operate.

Both categories, whether open protocols or multi chain protocols will undoubtedly take the blockchain space into the realm of more realistic case use.

3. Governance & Different Consensus Protocols

As blockchains continue to adopt major usage, governance becomes a vital debate in this space. As usage increases, the most successful blockchains will be the ones that adapt to their environments and criticisms.

Important aims of governance is to effectively incentivise partaking by all parties involved in the blockchain. Two most important components for governance are as follows;

Rewarding Partakers

Blockchains reward their users for taking part in the system. It is due to this, users are incentivised to act in unity and take part in the protocol. Incentives are not fixed or equal, they can be altered by all the users

of the blockchain and can be adjusted as times move on.

Structure for coordination

Since the satisfaction of all parties is not possible, a good governance would entail the incentivisation for all parties so that they act to coordinate their common interests and also have a way of proposing changes.

Governance differs from blockchain to blockchain and as usage increases, this is becoming a major debate. Changes to Bitcoin are handled differently compared to Tezos. Investments into the space will need to take into account,

usage increases over time and look into blockchains that have flexible governance mechanisms allowing for changes to take place in the future as they continue to progress.

4. Scaling

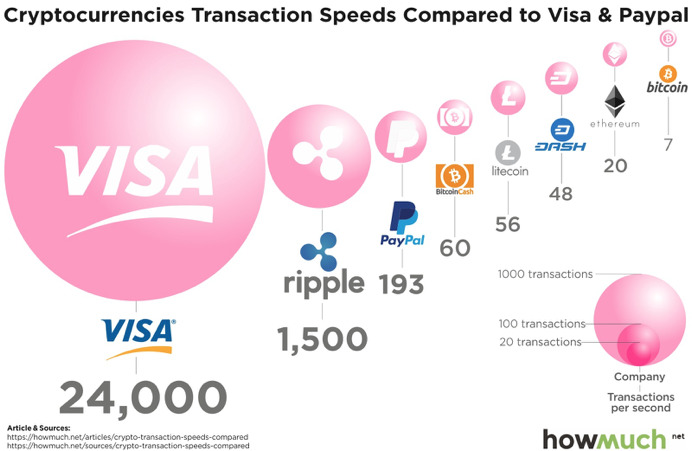

With the increasing growth of blockchain platforms, scaling has become a very important issue and discussion in recent years. Although blockchains solve the trust issue and introduce a trustless mechanism between parties

transacting, it also slows the process down drastically compared to the other solutions in the market. Decentralised platforms establish numerous players in the verification process and thus slows down transaction

speeds compared to a centralised protocol which has a one-point verification system or are otherwise colloquially known as a traditional database.

Trusted third parties such as Paypal and Visa can handle multiple times more transactions than Bitcoin and Ethereum, comparing 24,000 transactions per second for Visa to 7 transactions per second for Bitcoin. This gap

is astounding and remains an important and somewhat complex barrier to mainstream adoption.

We approach the scaling problem by investing in both on-chain and off-chain scaling solutions to improve the number of transactions per second and also to not compromise on the decentralisation of blockchains.

Layer 1

Layer 1 scaling involves making integral changes on the mainchain. Generally, every transaction has to be approved and where every node has to keep a complete record of all the transactions to produce valid consensus

on any transaction. This is problematic as it creates issues of storage. Furthermore, it also presents issues for the blockchain itself, such as increasing the block size and time taken to record all transactions

i.e block time.

Sharding is one solution suggested to the problem of scaling. Sharding which is used in traditional database scaling can also be used in structuring blockchains and lowering node capacity. It is essentially

splitting up databases into smaller, more manageable databases. However, this approach is problematic because it compromises the decentralisation of the database. This is due to the verification process, as

sharding entails that the network is split into various smaller sub-chains and nodes only verify transactions forwarded to its own node whilst not overlooking the entire network. In this scenario, multiple nodes

can process multiple transactions at the same time, operating semi-independently to increase transaction volume.

Layer 2

Layer 2 scaling is where transactions and processes are moved outside of the blockchain. This involves processing transactions outside the blockchain and moving them into bulk for settlement on the mainchain. Solutions

like Lightning Network or Raiden Network are Layer 2 settlement solutions. They propose to build separate nodes that operate parallel to the mainchain nodes. Due to their nature they can process transactions

on their own nodes and then finally move them onto the mainchain. This drastically decreases transaction times as they are approved instantly and can scale to an unlimited amount of transactions per second.

Another example of a scaling solution is Plasma. This is a similar idea which utilises smart contracts that are settled on the mainchain to build other various side-chains. This can be a hierarchical process and

these side-chains can operate semi-independently and do their own processing allowing side-chains to effectively process large numbers of transactions and even create their own hierarchical structures of further

side-chains.

5. Ecosystem Development and Usability

Development in the blockchain space has escalated, alongside the increasing prices in the recent years. As capital within the sector has increased, so has the developer interest. Increasing development within

the blockchain space has attracted new players to the market.

Although development is increasing at an alarming speed, blockchain infrastructure still lacks a solid programming ecosystem. For instance, building complex applications on decentralised smart contracts platforms

such as Ethereum still remains a highly convoluted area.

I see two limitations that allow for this;

We’re busy finding the “winner” blockchain, however;

We believe that a multitude of platforms all working with each other is the best approach in this sector. This allows each of the platforms to interact and communicate with each whilst utilising their own specific

functions and allows us to utilize the best practises of each platform by building a bridge and utilizing each of the platforms specific functions.

Lack of appropriate protocols that streamline the development process

According to Academy Token, there are 14 open jobs for every blockchain engineer. Although the blockchain space has seen a tremendous growth in developers leaning towards the space, it is not enough. We believe

that if more tools that streamline the development process are introduced, this will in turn allow developers to easily create applications in this space. Projects such as 0xProject serve as a prime example,

a decentralised exchange protocol which allows anyone to simply use their documentation and build on top of their protocol.